In our April 28, 2023 blog post, we discussed the letter of intent process and the role that it plays in the sale of your dental practice. One potential item included in the letter of intent is rollover equity. In today’s market, “rollover equity” is a common business term in any dental practice sale to dental support organizations—commonly referred to as DSOs. Thus, when reviewing the letter of intent, it is important to have a working knowledge of what rollover equity is, how it is structured, and what the pros and cons are of accepting rollover equity versus a traditional cash payout.

So, What Is Rollover Equity?

Rollover equity refers to the portion of the proceeds from the sale of your dental practice that you reinvest into the holding company that the DSO uses to acquire dental practice assets. Most private equity (“PE”) firms prefer that a Seller roll over at least 25 – 30% of their proceeds into the Purchaser’s dental holding company, post-acquisition. The rollover equity generally involves a Seller contributing their personal goodwill to the dental holding company in exchange for unit ownership. That is, the Seller is receiving units in a limited liability company (i.e., the dental holding company) versus an immediate cash payout, with the hope that the dentist receives a bigger cash payout later.

Nardone Comment: As part of these transactions, the rollover can be structured as a tax-deferred rollover, so capital gains are deferred until a future sale of the equity, commonly referred to as a recapitalization event. So, instead of receiving additional dollars in cash, and paying capital gains taxes on that cash at the time of closing, a Seller gets to roll over the agreed upon amount, tax-deferred. It is a big deal, and this is where the “potential” of life-changing earnings may arise.

How Is It Structured?

As stated above, rollover equity usually occurs in a transaction in which the Purchaser is a DSO and the Seller is a dentist. Most DSOs are backed by PE firms in some way, which provide the DSOs with the flexibility and opportunity to provide this benefit to the Seller in these DSO transactions.

From our perspective, there are two main goals of utilizing rollover equity. First, it allows the Purchaser to pay an increased enterprise value for the dental practice assets without having to make an additional cash outlay. And second, the PE firms want to ensure alignment of incentives so that the Seller has a vested stake in the future success of the overall DSO. By having a vested stake, it lowers the risks of the transaction and brings the parties into alignment on the success of the overall vertical. As stated above, the minimum rollover equity most PE firms expect is a 25 – 30% stake, and the amount is generally capped at 50%. It just depends upon the specific PE firm, DSO, and the timing of the next recapitalization event.

Many rollover equity transactions are effectuated by entering into a unit holder and contribution agreement. As part of that agreement, the selling dentist contributes personal goodwill in exchange for the units in the DSO holding company. The units are valued at fair market value by the PE firm backing the DSO at the time of the initial closing of the sale of the dental practice assets. Generally, no actual money is exchanged for the rollover portion. Rather, it is a paper transaction, and tax is deferred. This is often done under Internal Revenue Code Section 721. Section 721 allows a taxpayer to transfer property in various forms to a partnership (or another entity such as an LLC taxed as a partnership) in exchange for shares in that partnership.

Recapitalization Events

In addition to the tax-deferred treatment of the rollover portion of the purchase price, rollover equity can provide additional benefits that come with investment, including recapitalization events. These recapitalization events occur when the PE firm that owns the DSO platform refinances a portion of their debt or sells the overall investment to a larger PE firm, allowing for a Seller to convert their rollover equity, or a portion of it, into cash.

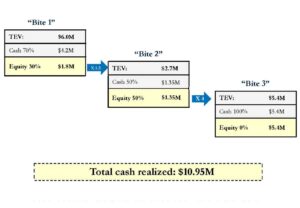

As an example, let’s say that you have an offer for a total enterprise value (“TEV”) of $6 million. Seventy percent of the enterprise value may be paid out at closing in cash (i.e., $4.2 million), subject to certain holdbacks. And the other 30% of the enterprise value (i.e., $1.8 million) will be rolled over as the equity in the overall holding company.

The example chart above reflects the initial cash payout of the $4.2 million, subject to certain holdbacks, and the initial rollover of the $1.8 million. It then shows two hypothetical recapitalization events culminating in a complete liquidation of the initial $1.8 million rollover investment, generating a total cash outlay from the rollover investment of $6.75 million ($1.35 million + $5.4 million). So, although the total enterprise value was initially $6 million, after the two recapitalization events and the liquidation of the overall investment, the selling dentist actual realizes $10.95 million ($4.2 million + $6.75 million). Now, as discussed below, this is all subject to the market, headwinds, speculation, and many other factors. Thus, you want to ensure, as the selling dentist and now investor, you are asking a lot of questions, and ensuring that you understand the relevant DSOs’ and PE firms’ track records, otherwise referred to as their street credibility in the DSO market and recap event space.

What Are the Pros and Cons?

As outlined above, the main advantage of rollover equity is increased cash in the future, above and beyond the TEV. Additionally, if structured properly, the tax on the rollover equity portion is deferred until the dollars are realized.

Nardone Comment: Note that we talk about “tax-deferred” not “tax free.” We hear a lot of folks refer to the tax-free nature of these transactions. But let’s remember, if you make money, you will pay tax, at some point. So, let’s use the proper terminology. It is tax-deferred, not tax free. As one of our clients has said many times, you can always fix the tax problem by simply not making any money. J

The main disadvantages of rollover equity are that you do not get the cash up front at the time of closing and the rollover equity is subject to risk and exposed to the same economic realities and headwinds of any other investment that you may make during your lifetime. The investment is further subject to the DSO’s and PE firm’s desires and decisions on when and how to structure that hypothetical recapitalization event(s) culminating in the complete liquidation of your investment. Therefore, you should ensure that you ask questions and ensure that you are comfortable with taking on some risk.

Rollover Equity Due Diligence Process

While a Purchaser will perform in-depth due diligence on the Seller, a Seller who is a party to a transaction with a rollover equity component should perform their own due diligence on the Purchaser. Participation in a transaction with a rollover equity component should be seen as an investment in the ongoing success of the Purchaser’s business.

A Seller who agrees to rollover equity is choosing to link the success of that investment to the Purchaser’s success. To protect that investment, the Seller should perform at least some level of both legal and financial due diligence, including gathering information related to the track record of both the Purchaser and the PE firm backing the DSO and the current and projected growth of the DSO platform. The Seller should undertake this diligence in the same way as with any other serious investment for the same amount of cash that is being rolled over. This process should be overseen by the Seller’s consultants, including attorneys and accountants.

Conclusion

In sum, when considering your overall succession planning options for your dental practice, DSOs are simply one of those options. And, if the DSO option is one that you are seriously considering, you need to then dig into the details of the DSO’s offer, including the rollover equity. It is all about making an informed decision.

Vince Nardone is a partner with Benesch, with a focus in Benesch’s healthcare practice, and specifically a leader in the dental industry. He is a thought leader and regular speaker in the dental industry. He may be reached at (614) 223-9326 or vnardone@beneschlaw.com.

Angelina Campin is an associate with Benesch, and focuses her practice on healthcare matters in both transactional and regulatory areas. She may be reached at (312) 506-3424 or acampin@beneschlaw.com.

Angelina Campin is an associate with Benesch, and focuses her practice on healthcare matters in both transactional and regulatory areas. She may be reached at (312) 506-3424 or acampin@beneschlaw.com.

Vince Nardone Discusses Employment Contracts with Ohio State Dental Students

Vince Nardone Discusses Employment Contracts with Ohio State Dental Students  Navigating the 2024 Landscape: Strategies and Considerations for Dental Support Organizations (DSOs)

Navigating the 2024 Landscape: Strategies and Considerations for Dental Support Organizations (DSOs)  Sellers of Dental Practices to DSOs need to have a Buyer’s Mentality Requiring Selectivity and a Well-Thought-Out, Decision-Making Process

Sellers of Dental Practices to DSOs need to have a Buyer’s Mentality Requiring Selectivity and a Well-Thought-Out, Decision-Making Process  Increasing Profitability by Minimizing Disruptions within Your Dental Practice

Increasing Profitability by Minimizing Disruptions within Your Dental Practice  As a Dentist, What Are My Obligations Related to Out-of-State Patients and Potential Prescription Drug Abuse?

As a Dentist, What Are My Obligations Related to Out-of-State Patients and Potential Prescription Drug Abuse?